Goat Funded Trader Review

Exclusive Code 10%: «PROP10»

Overview of Goat Funded Trader for Indian Market

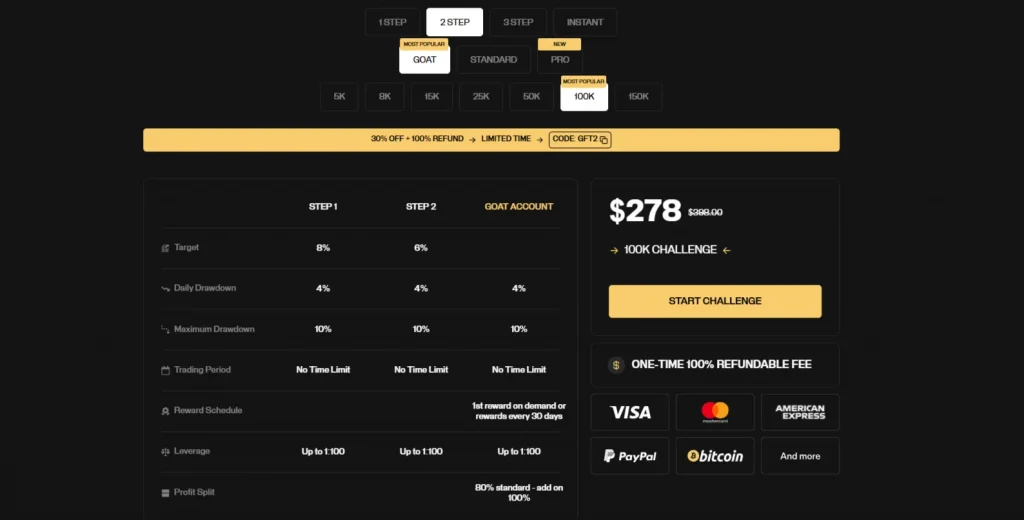

Goat Funded Trader presents Indian traders with a diverse array of funding options, catering to various trading styles and experience levels. The company offers seven distinct programs, including three two-step evaluations, a one-step evaluation, a three-step evaluation, and two instant funding options. These programs provide Indian traders access to accounts ranging from $5,000 to potentially $2 million in trading capital.

Goat Funded Trader utilizes ThinkMarkets as its broker, offering a wide selection of tradable instruments such as forex pairs, commodities, indices, stocks, and cryptocurrencies. Indian traders benefit from leverage up to 1:100, depending on the chosen program and instrument. The firm’s commitment to trader success is evident through its competitive profit splits, ranging from 80% to 100% for most programs.

| Program Type | Profit Target (Phase 1) | Max Daily Loss | Max Total Loss | Profit Split |

| Goat Challenge | 8% | 4% | 10% | 80-100% |

| Standard Challenge | 10% | 5% | 10% | 80-100% |

| Pro Challenge | 8% | 4% | 8% | 80-100% |

| One-step Challenge | 10% | 4% | 6% | 80-100% |

| Three-step Challenge | 6% (each phase) | 4% | 8% | 80-100% |

| Standard Instant Funding | N/A | 4% | 8% (Trailing) | 65-95% |

| Goat Instant Funding | N/A | 3% | 6% (Trailing) | 80-100% |

Goat Challenge Program Details for Indian Traders

Evaluation Steps: Two-step process

Account Sizes: Ranges from 5,000 to 150,000 USD

Phase 1 Profit Target: 8%

Phase 2 Profit Target: 6%

Maximum Daily Loss: 4%

Maximum Total Loss: 10%

Maximum Trading Days: No limit

Minimum Trading Days: 3 per phase

Funded Account Profit Split: 80% to 100%

First Payout: On-demand or after 30 calendar days

Standard and Pro Challenge Programs for Indian Market

Feature | Standard Challenge | Pro Challenge |

Phase 1 Profit Target | 10% | 8% |

Phase 2 Profit Target | 5% | 4% |

Maximum Daily Loss | 5% | 4% |

Maximum Total Loss | 10% | 8% |

Minimum Trading Days | 3 per phase | 3 per phase |

Funded Account Profit Split | 80% – 100% | 80% – 100% |

Flexibility | Higher profit targets, more risk | Lower loss limits, conservative approach |

One-step and Three-step Challenge Options

Feature | One-step Challenge | Three-step Challenge |

Evaluation Steps | Single-step | Three-step |

Profit Target | 10% | 6% per phase |

Maximum Daily Loss | 4% | 4% |

Maximum Total Loss | 6% | 8% |

Funded Account Profit Split | 80% – 100% | 80% – 100% |

Target Traders | Faster evaluation, higher risk | Gradual progression, structured approach |

Trading Platforms and Instruments Available to Indian Traders

Goat Funded Trader provides Indian traders access to three sophisticated trading platforms:

- Platform 5: Advanced charting and analysis tools

- Match-Trader: User-friendly interface with quick order execution

- TradeLocker: Specialized risk management features

| Asset Class | Examples | Number of Instruments |

| Forex | EUR/USD, GBP/JPY, AUD/CAD | 50+ pairs |

| Commodities | Gold, Oil, Wheat | 10+ products |

| Indices | S&P 500, FTSE 100, Nikkei 225 | 15+ indices |

| Stocks | Apple, Amazon, Tata Motors | 100+ equities |

| Cryptocurrencies | Bitcoin, Ethereum, Ripple | 20+ cryptocurrencies |

Educational Resources and Support for Indian Traders

Goat Funded Trader emphasizes trader education and support through various resources:

- Detailed blog posts covering trading strategies and market analysis

- Video tutorials on platform features and risk management techniques

- Live webinars hosted by experienced traders and market analysts

- One-on-one coaching sessions for funded traders (subject to account size)

- Economic calendar highlighting key market events

- 24/7 customer support via live chat, email, and phone

These educational tools aim to enhance the skills of Indian traders, improving their chances of success within the Goat Funded Trader programs. The company’s commitment to trader development extends beyond initial funding, fostering long-term growth and profitability.

Performance Analytics and Reporting for Indian Traders

| Metric | Description | Frequency |

| Win Rate | Percentage of profitable trades | Real-time |

| Average RRR | Risk-reward ratio across all trades | Daily update |

| Sharpe Ratio | Risk-adjusted return measurement | Weekly calculation |

| Drawdown Analysis | Maximum account value decrease | Real-time |

| Instrument Performance | Profitability by traded asset | Daily update |

| Time Analysis | Trading performance by time of day | Weekly report |

FAQ:

Yes, Indian traders can participate in multiple programs concurrently, provided they meet the initial investment requirements for each program separately.

For most programs, the first payout is available on-demand or after 30 calendar days, subject to meeting a 3% profit requirement and completing a minimum of 3 trading days.

While Goat Funded Trader allows various trading strategies, certain practices such as arbitrage, expert advisors with high-frequency trading, and trading during major news events may be restricted. Traders should review the specific terms for each program.