Goat Funded Trader Leverage

Exclusive Code 10%: «PROP10»

How Goat Funded Leverage Is Structured

Leverage is the multiple of your trading capital that you’re allowed to use. Goat Funded Trader defines specific leverage rules depending on two things:

- The instrument you’re trading

- Whether you’re on an evaluation or funded account

From the official breakdown:

Instrument Type | Evaluation Account | Funded Account |

Forex | 1:100 | 1:50 |

Indices | 1:20 | 1:10 |

Commodities | 1:20 | 1:10 |

Crypto | 1:2 | 1:2 |

On evaluation accounts, you can trade with up to 100 times your capital on forex pairs. However, once you pass and begin managing real funds, this is reduced—Forex, for instance, drops to 1:50.

This is a recurring principle in Goat Funded Leverage: you get access to larger positions while being evaluated, but after that, the firm prioritizes capital protection.

Why the Change After Evaluation?

You may wonder why leverage is reduced after you get funded. The answer comes down to risk ownership. While you’re in evaluation, losses don’t affect the firm’s capital. Once funded, however, you are trading on company resources.

Here’s what changes:

- Account shifts from simulation to real capital

- Goat Funded Trader carries the financial risk

- You must demonstrate ongoing risk discipline to regain full leverage

Their system is designed to reward consistency over time. According to their documentation, you can apply to restore your max leverage once your trade history proves you’re managing drawdown and trade size properly.

Application Across Account Models

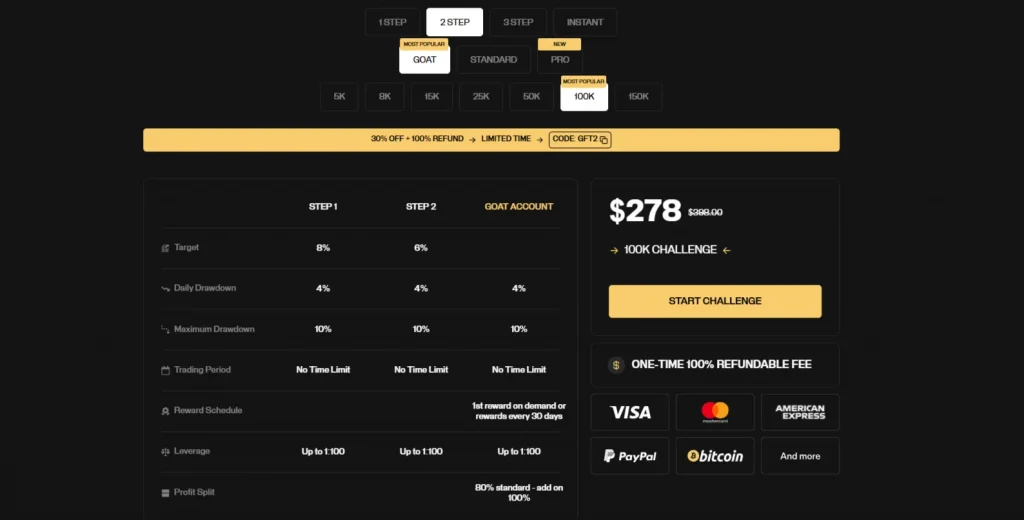

Every account type at Goat Funded Trader follows this leverage policy:

- 1-Step Evaluation

- 2-Step Challenge

- 3-Step Model

- Instant Funding

- Goat Blitz

Regardless of entry path, Goat Funded Leverage follows a consistent logic. For example:

All evaluation phases provide the following leverage:

- Forex: 1:100

- Indices and Commodities: 1:20

- Crypto: 1:2

Once funded, this leverage adjusts down as shown in the table earlier. The only exception is crypto, which stays capped at 1:2, due to its high volatility.

Leverage vs Drawdown and Risk Limits

Leverage isn’t just a tool—it’s a multiplier of risk. That’s why every leverage allowance at Goat Funded is paired with clear drawdown limits:

- Daily loss limit: 4% on evaluation; 3% once funded

- Overall loss limit: 6% evaluation; 5% funded

- No lot-size restrictions, but breaching rules leads to account termination

This means that even with 1:100 leverage, you’re responsible for staying within drawdown boundaries. For example, if you have a $100,000 evaluation account, you could technically control up to $10 million in positions. But that doesn’t mean you should.

Here’s a risk comparison:

Scenario | High Leverage Used | Low Leverage Used |

Market moves -1% | Loss is 1% | Loss is negligible |

Market moves -3% | Possible violation | Low impact if sized well |

Stop-loss triggered | Amplified impact | Manageable loss |

Position size control | Harder | Easier |

This framework makes it clear that Goat Funded Leverage is only as useful as your trade discipline allows.

Implications for Your Trading Strategy

You should treat leverage not as a benefit, but as a constraint to manage with care. Based on what Goat Funded provides, consider the following strategy layers:

Leverage Management Tips

(1 out of 3 allowed lists)

- Keep position sizes proportional to actual account balance, not maximum exposure

- Use leverage only when setups are high-confidence

- Align stop-loss levels with drawdown tolerances

- Avoid holding leveraged positions overnight during news releases

Even with leverage available, you’re the one who has to make sure it doesn’t exceed your margin for error.

Leverage and Profit Split

One important thing to note is that higher leverage does not impact your payout rate. Whether you’re trading 1:50 or 1:100, the profit split remains the same:

Account Type | Profit Split |

Funded Account | Up to 90% trader share |

Evaluation Phase | No payouts |

This means using more leverage doesn’t result in higher reward unless you’re consistently profitable within risk rules. In fact, reckless use of leverage can cancel your funded status, and that resets your journey entirely.

Final Thoughts on Goat Funded Leverage

If you came here looking for details, you now know exactly how Goat Funded Leverage works across different stages and account types. It’s structured, consistent, and governed by strict risk policies.

In summary:

- Evaluation phases offer maximum leverage (up to 1:100 for Forex)

- Funded accounts reduce that leverage (Forex down to 1:50) to manage real capital risk

- The structure is not flexible unless your trade performance justifies adjustments

- Drawdown rules and risk management are tightly integrated with leverage access

This system isn’t built to give you freedom—it’s built to protect the firm’s capital and test your ability to trade responsibly under pressure.

FAQ:

Up to 1:100 on Forex, 1:20 on indices and commodities, and 1:2 on crypto.

Leverage is reduced—Forex drops to 1:50, indices and commodities to 1:10, crypto remains 1:2.

Yes, if you show consistent low-risk trading, your account may qualify for leverage restoration.