Goat Funded Trader About Us

Exclusive Code 10%: «PROP10»

Company Origins and Structure

Goat Funded Trader launched in 2022 with a clear mission: to provide traders with a transparent, supportive, and tech-driven environment. Key facts from their about page:

- Founded in 2022 – relatively new, rapidly scaling

- 100% In-House Technology – full control over platform backend

- Team of 40+ Professionals – internal support, tech, compliance, and trader relations

Their in-house tech architecture supports live performance tracking, risk management automation, challenge mechanics, payout processing, and scaling without relying on white-label tools.

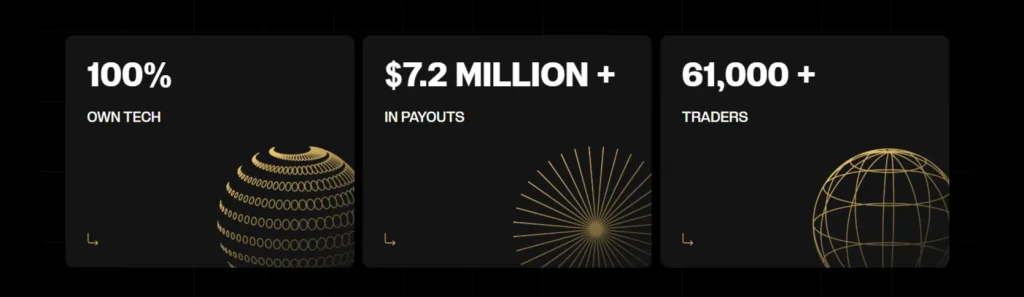

Performance Metrics and Achievements

Metric | Value |

Total Payouts | $9.1 million+ |

Supported Countries | 180+ |

Registered Traders | 98,000+ |

Daily Trades Processed | 36,000+ |

Active Trading Accounts | 111,000+ |

Daily Active Traders | 7,000+ |

The company also supports over 30 prop firms with its infrastructure and sponsors events like the Dubai Forex Expo, according to official sources.

Community, Support, and Tech Ecosystem

- Over 40 internal staff across departments

- Entire system (including TradeLocker) built in-house

- User support via chat, ticket, email, and social platforms

- Real-time rule tracking and account analytics

- Dubai Forex Expo sponsor and ecosystem partner to other prop firms

Their focus on self-hosted solutions is marketed as a long-term edge over competitors relying on leased platforms or EA-limited infrastructure.

Platform Credibility and Risks

Despite strong data points, some limitations are present:

- Still a young company (founded in 2022), so long-term reliability is not yet proven

- Transition from MT4/MT5 caused downtime and user confusion — now shifted to TradeLocker

- No third-party uptime audit publicly shared; trust depends on in-house monitoring

- While payout volume is solid, exact account-level verification or regulator oversight is minimal

That said, the model supports active trading without waiting periods, which is frequently cited in positive community feedback.

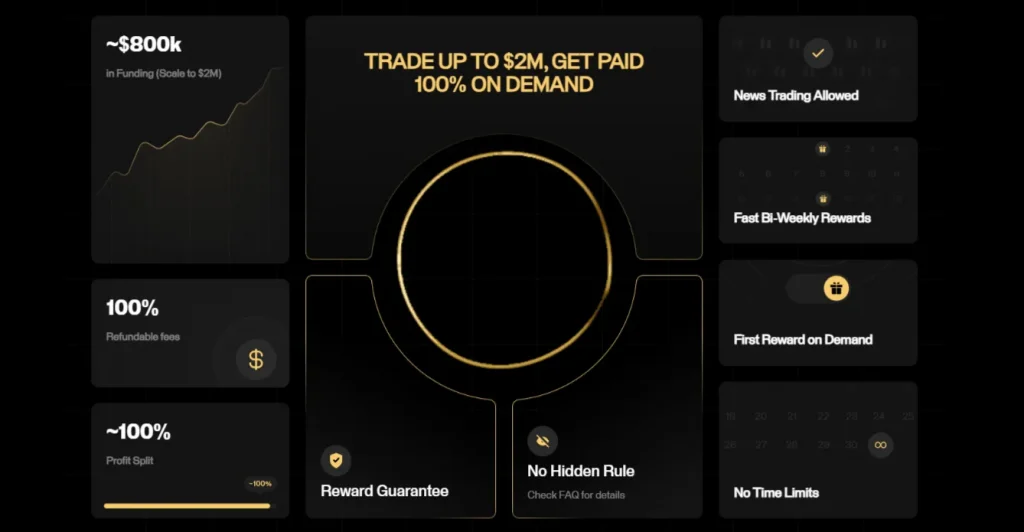

What Traders Should Consider

- All account functions run on proprietary tools

- 100% profit splits possible with scaling

- Salaries offered to qualified funded traders

- Instant payout after successful evaluation

- Pricing lower than many competitors on larger accounts

These points support the firm’s goal of attracting consistent, scalable traders—especially those frustrated by long wait times or strict EA bans elsewhere.

Final Thoughts

Goat Funded About Us describes a company focused on internal control, global scale, and accessible funding. They target traders looking for faster payouts and a tech ecosystem not dependent on MetaQuotes. As a new but ambitious prop firm, they combine aggressive scaling opportunities with self-developed systems. Their future impact will depend on how well they maintain uptime, manage volume, and support traders over time.

FAQ:

In 2022, with a focus on a fully in-house platform and automation.

Over $9.1 million has been paid across 98,000+ registered traders.

No. Goat Funded operates its own tech stack including the TradeLocker platform.