Goat Funded Trader

Exclusive Code 10%: «PROP10»

Goat Funded Trader for Indian Traders

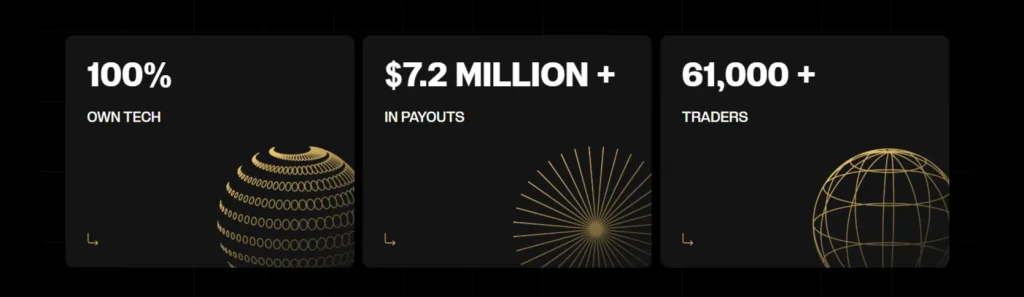

Goat Funded Trader presents Indian traders with an array of opportunities to access substantial trading capital. The firm offers seven distinct funding programs, catering to various trading styles and experience levels. These programs include three two-step evaluations, a one-step evaluation, a three-step evaluation, and two instant funding options.

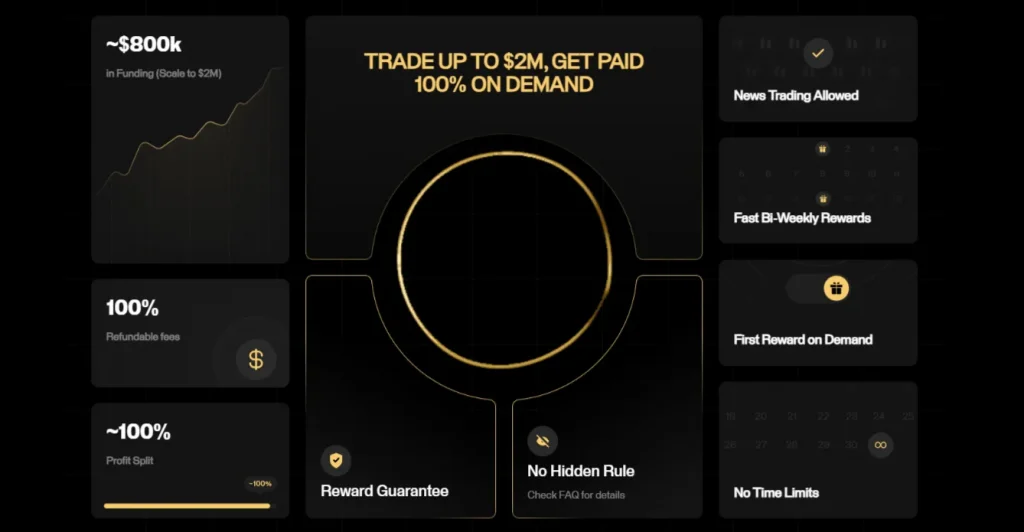

Traders can potentially manage accounts ranging from $5,000 to $2 million, with profit splits reaching up to 100%. The company partners with ThinkMarkets as its broker, providing access to a wide range of financial instruments, including forex, commodities, indices, stocks, and cryptocurrencies. Indian traders benefit from leverage up to 1:100, depending on the chosen program and traded instruments.

Diverse Funding Programs Tailored for Indian Market

Goat Funded Trader’s seven funding programs cater to the diverse needs of Indian traders:

Funding Program | Evaluation Steps | Profit Targets (%) |

Goat Challenge | Two-step | 8% (Step 1), 6% (Step 2) |

Standard Challenge | Two-step | 10% (Step 1), 5% (Step 2) |

Pro Challenge | Two-step | 8% (Step 1), 4% (Step 2) |

One-step Challenge | Single-step | 10% |

Three-step Challenge | Three-step | 6% per phase |

Standard Instant | No evaluation | No profit target |

Funding | ||

Goat Instant Funding | No evaluation | No profit target |

Each program offers unique features, including unlimited trading periods, scaling plans, and first payout on-demand options. These diverse offerings allow Indian traders to select the program that best aligns with their trading strategy and risk tolerance.

Trading Platforms and Instruments for Indian Traders

Goat Funded Trader provides Indian traders with access to three advanced trading platforms:

- Platform 5

- Match-Trader

- TradeLocker

These platforms offer a user-friendly interface and advanced charting tools, catering to both novice and experienced traders. Indian traders can access a wide range of financial instruments:

- Forex: Over 50 currency pairs

- Commodities: Gold, silver, oil, and agricultural products

- Indices: Major global stock indices

- Stocks: Hundreds of international stocks

- Cryptocurrencies: Bitcoin, Ethereum, and other popular altcoins

This diverse selection enables Indian traders to implement various trading strategies across multiple asset classes.

Profit Targets and Drawdown Rules for Indian Traders

The Smart Drawdown scaling system enables account growth up to $1.28 million. Traders achieving 10% profit targets receive automatic balance doubles. Static Drawdown accounts scale through 25% increments every 90 days. The system tracks scaling eligibility through automated performance monitoring. Balance increases reflect in real-time upon target achievement.

Performance Metrics Table:

Goat Funded Trader sets realistic profit targets and drawdown rules for Indian traders:

Program | Phase 1 Target | Phase 2 Target | Max Daily Loss | Max Total Loss |

Goat | 8% | 6% | 4% | 10% |

Standard | 10% | 5% | 5% | 10% |

Pro | 8% | 4% | 4% | 8% |

One-step | 10% | N/A | 4% | 6% |

Three-step | 6% (x3) | N/A | 4% | 8% |

Instant funding programs have no profit targets but maintain similar drawdown rules. These balanced requirements allow Indian traders to demonstrate their skills without excessive pressure.

Scaling Opportunities for Indian Traders

Indian traders can significantly increase their account sizes through Goat Funded Trader’s scaling plans. Upon reaching specific profit milestones, traders can double their account balance. For example, the Standard Instant Funding program allows scaling up to three times, potentially growing a 50,000accountto50,000 account to 50,000accountto400,000. This scaling feature provides substantial growth potential for successful Indian traders.

Profit Split and Payout Structure for Indian Traders

Goat Funded Trader offers competitive profit splits to Indian traders:

- Evaluation programs: 80% to 100% profit split

- Standard Instant Funding: 65% to 95% profit split

- Goat Instant Funding: 80% to 100% profit split

The first payout is available on-demand for most programs, with subsequent payouts processed bi-weekly or monthly. Indian traders can choose between immediate 40% profit splits or higher percentages after a waiting period, allowing flexibility in managing their earnings.

Trading Fees and Commissions for Indian Market

Goat Funded Trader maintains a transparent fee structure for Indian traders:

Instrument | Commission Fee |

Forex | $7 per lot |

Commodities | $5 per lot |

Indices | $0 per lot |

Stocks | $0 per lot |

Cryptocurrencies | $0 per lot |

This competitive fee structure allows Indian traders to maximize their profits across various asset classes. The firm also provides raw spreads from 0.1 pips, further reducing trading costs for Indian participants.

Educational Resources for Indian Traders

Goat Funded Trader supports Indian traders with comprehensive educational resources:

- Detailed blog covering trading tips, general market information, and educational content

- VIP Goat Traders section featuring insights from successful traders

- Lot Size Calculator for efficient risk management

- Professional trading dashboard for real-time performance tracking

These resources help Indian traders improve their skills and make informed trading decisions.

Customer Support for Indian Traders

Goat Funded Trader provides robust customer support for Indian traders:

- Live chat for immediate assistance

- Email support: [email protected]

- Discord community for peer interaction

- Comprehensive FAQ section

- Support in English and Spanish

This multi-channel support system ensures Indian traders can quickly resolve any issues or queries, enhancing their trading experience.

Account Opening Process for Indian Traders

Indian traders can easily open an account with Goat Funded Trader:

- Complete the registration form with personal details

- Choose the preferred account type and trading platform

- Select account size and add-on features

- Choose a payment method (credit/debit card, CentroBill, or cryptocurrency)

This streamlined process allows Indian traders to start their funded trading journey quickly and efficiently.

Trustpilot Ratings and User Feedback from Indian Traders

Goat Funded Trader has garnered positive feedback from the trading community, including Indian traders. The firm maintains a Trustpilot rating of 4.2 out of 5 stars, based on 2,920 reviews. Notably, 69% of reviewers have awarded the company a 5-star rating. Indian traders frequently praise the platform’s automated nature, prompt payout process, and comprehensive coverage of trading needs.

Table: Trustpilot Rating Breakdown

Rating | Percentage of Reviews |

5 stars | 69% |

4 stars | 15% |

3 stars | 7% |

2 stars | 4% |

1 star | 5% |

These ratings reflect the overall satisfaction of traders, including those from India, with Goat Funded Trader’s services.

FAQ:

Yes, Indian traders can participate in all seven funding programs offered by Goat Funded Trader, including the evaluation challenges and instant funding options.

Indian traders can potentially manage accounts up to 2 million through Goat Funded Trader’s scaling plans, starting from initial account sizes of $5,000 to $200,000.

Most programs offer first payout on-demand, allowing Indian traders to receive their earnings as soon as they meet the 3% profit requirement and complete the minimum trading days.